Originally posted on Archetype Mirror

Written by Katie Chiou, Graeme Boy

The word that best sums up consumer technology in the 2010s is gamification. In retrospect, this makes sense, given where technology was at the time. We were entering the mobile and the social eras simultaneously, where everyone essentially now had a connected, networked game device in their pocket at all times.

The early gamification trend ushered in a wave of companies that sought to make games out of normally mundane activities and transform them into booming businesses. It turned visiting places into a game (Foursquare, 2009), monitoring traffic into a game (Waze, 2008), language learning into a game (Duolingo, 2011), the list goes on. What these companies realized was that gamification was an effective strategy for generating promotion, marketing, engagement, and loyalty with their users.

One of the common elements of gamification is a point system, where you can translate qualitative measures of progress into quantifiable metrics. Point systems fundamentally accomplish two ends: binary, legible outcomes (number go up, number go down) and channels to easily direct intrinsic motivation toward extrinsic motivations (perks, streaks, and rewards).

Blockchains are natural infrastructure for point systems because they’re designed as a universal ledger of entities with rails that can programmatically distribute value to these entities based on certain actions.

Historically, this value has largely been distributed through tokens on Ethereum (ERC20s)—financial assets whose value adjusts in real-time in open markets. Tokens are powerful tools for identifying, coordinating, and compensating users who contribute productively to a network with financial rewards and/or shares of ownership.

Token incentives have been critical for blockchain usage. The promise of tokens as financial rewards act as a counterbalance to the relatively high costs and often high risks of transacting on L1s like Ethereum. However, this dynamic can create a vicious cycle. The high cost of onchain transactions means that rewards often go to the users who are willing to pay high fees (often mercenary capital) and are generally not favorable to participants who are less willing to pay high fees or are more risk averse (often new users).

As blockchains transactions rapidly become cheaper—through the proliferation of L2s and L3s—broader classes of non-financial actions become feasible to bring onchain without the urgency and expectation to compensate users with requisite financial rewards. This new paradigm signals the emergence of new onchain primitives such as attestations to identify, coordinate, and engage a complex, decentralized network of users.

Onchain attestations are a method for identifying and classifying users, allowing users to self-attest to their own attributes and to attest to those of others. However, attestations have their own limitations. Attestations are often qualitative, which makes them difficult to use in a low-context, computational environment such as a blockchains. For example, it’s generally much easier to compare a player with 20 kills in a game vs. a player with 12 kills in the same game than it is to compare a player who killed the Green Boss vs. a player who killed the Blue Boss in the same game. This can be improved by increasing the context of the environment, and further scaling combined with developments in AI and LLMs will also make this type of analysis easier. However, given these limitations, it’s likely that more quantitative forms of attestations are most appropriate for where blockchain scalability is today.

We’ve seen experimentation with point systems in crypto begin to take off such as Blur points, which utilizes forms like “Listing Points” and “Lending Points” to incentivize specific actions and to distribute rewards that may include $BLUR tokens. More recently, Rainbow began issuing Rainbow Points to reward users for making transactions in the Rainbow wallet. To date, these point experimentations have largely been offchain, which makes them relatively similar to web2 points programs, at least implementation-wise.

Beyond traditional point systems, onchain points present an interesting opportunity to use points trustlessly within blockchain environments for purposes such as token redemptions for ownership distribution, access gating for sybil resistance, or improving market functionality in DeFi.

The rest of this post serves to illustrate the differences and tradeoffs between tokens, offchain points, and onchain points, and to explore the extent to which onchain points can serve as an additional primitive for builders and users with its own unique benefits and challenges.

Why Points

In the case of tokens, there are many characteristics that are carefully scrutinized pre-launch and can materially impact the resulting traction of the project and price of its token. Some of these factors include, but are not limited to:

-

Supply and Issuance: Will the token be inflationary or deflationary?

-

Usage: Will the token be used for governance, and if so, will holding governance tokens represent a claim on any fees generated by the project and control over the allocation of the project’s treasury? Or will the native token be used for utility? Will it be the unit of account/integral to using the project?

-

Value accrual: Are there staking mechanisms or lockups? Are tokens spent and/or burned as a means of scarcity and value accrual?

-

Distribution: Will tokens be distributed through airdrops or emissions? Will there be vesting schedules?

In the case of points, they are usually non-financial, mutable, and controlled by the issuer, meaning that point systems can be easily adjusted without immediately impacting any market dynamics. Point supply can be unlimited, and the method by which points are used/redeemed can be modified. Moreover, the tradeability of points is also determined by the issuer, whereas tokens are tradeable by design.

Being able to adjust point systems and receive community feedback in real-time without fundamentally changing market dynamics, product mechanics, or user behavior gives teams much more time and awareness to understand and better retain users. In the case that points are used as precursors to tokens, points help remove the urgency for a project to define its token model and distribution too early since it can determine later what proportion of the token supply will be allocated to the aggregate point pool.

Notably, of course, because point systems have established precedence in web2, evaluating them from a regulatory lens is arguably less questionable.

Not only are points more simple to design and execute for builders, they’re much simpler for users. Given the dynamicity of token price, users can find it difficult to know how to conceptualize a certain token: Should I treat it as an investment or as a utility/access tool? For example, imagine an arcade game where you have to pay a quarter to play the game. If you knew that tomorrow that quarter could be worth $10, you might be more hesitant to feed that quarter to the machine.

Points, alternatively, can be thought of as “meta-currencies,” where points can convert into financial value and influence usage, but this conversion can be designed to be less or more direct, depending on the situation. In this model, the redeemability of points becomes much more flexible.

In terms of point utility, points can be redeemable for a variety of options including direct product perks, ownership/equity of the project, governance rights, and/or directly swapped for income. These configurations can also be based on an opt-in basis for users.

Why Onchain Points

The more flexible nature of points raises an obvious question of what differentiates onchain points from offchain points. A key tension that emerges when thinking about tokens vs. points is that ERC20 tokens maximize composability and minimize issuer flexibility, while offchain points minimize composability and maximize issuer flexibility.

Implementing points onchain, rather than offchain, will likely sit somewhere between these two ends, allowing for flexibility while maintaining the benefits of blockchain auditability and composability.

But in practice, what does this really mean and why does it matter?

Composability

In a way, we can regard onchain points as quantitative attestations that people can view and leverage globally. Anyone can issue points to anyone else onchain, as well as build point systems based on other parties’ product usage or native point systems. Onchain points can add a new dimension to a user’s onchain identity, similar to accruing other onchain credentials, that can integrate into various modular protocols. With this framework, onchain points become a powerful tool that projects and brands can use to identify power users across products, and even attract prospective customers with discounts and airdrops.

Provenance

Onchain points also guarantee provenance and auditability, enabling transparency into the total allocation of points in the system, as well as a historical account of the methods of allocation. This transparency is vital to the extent that the point system becomes valuable to the project’s community and the demands for fairness in the allocation process.

For example, brands and agencies often work with influencers based on engagement metrics across platforms like YouTube, TikTok, Instagram, etc. However, these platforms configure and manipulate their algorithms for amplification and distribution in black box environments, making the logic behind metrics indiscernible.

Trust Guarantees

Blockchains allow for explicit guarantees on a user’s current point allocation and redemption options. These guarantees enable safe redemptions of points for other onchain assets with minimal trust assumptions, imbuing onchain points with a potential for value unprecedented in web2 point systems. Without blockchains, point systems that attempt to bridge value will suffer the same criticisms in the crypto community that we levy against web2 platforms—i.e., that they fail to satisfy a level of trust commensurate with their value—and that any stated redemption mechanism can be “rugged” without notice or historical trace.

Sybil Resistance

Point systems are also likely to impact “farming” activity that often accompanies web3 product launches. Bots can farm points just as they can tokens, but point systems can serve as a helpful communication mechanism between project teams and early adopters by explicitly signaling types of rewards that aren’t associated with a token and be used to encourage certain contributions to the product or network—for example, providing liquidity to a protocol or stress-testing certain features.

Community Accountability

Point allocations can also be held to community scrutiny before any redemption mechanisms are revealed in a more explicit manner than traditional airdrops, reducing risk of post-airdrop controversy. Onchain point allocations can even be audited, with a timestamped verification from a third-party.

Implementation

As we mentioned earlier, points can be designed for a variety of types of rewards ranging from discounts to product perks to ownership/equity of the project to governance rights to direct income. Similarly, points will likely differ widely in implementation across projects, ranging from some form of attestations to modified ERC20 tokens to soulbound tokens. While each method will have its own benefits and tradeoffs, we’ll walk through a likely common flow: redemption for ERC20 tokens.

While ERC20 tokens are the most composable method for distributing rewards, they generally minimize issuer flexibility and maximize speculative behavior. You can make modifications to effectively make them non-transferable or in unlimited supply; however, you still run into the common conflation of the token with a form of currency.

There’s also a cost consideration for implementing points as ERC20 tokens. The transaction costs of transferring ERC20 tokens onchain every time a user joins and/or a point balance is updated can get prohibitively expensive for the issuer. Alternatively, you could accumulate points in an offchain database into a Merkle tree and periodically publish the Merkle root onchain in a smart contract. When a user wants to claim the tokens, they submit a transaction to the smart contract that includes a Merkle proof that, when combined with the user's address and claim amount, can be verified against the published Merkle root (this is essentially how Merkle airdrops work). This is a common method of distributing tokens because it pushes transaction costs to the end user instead of the project—thereby distributing the total cost (which might be in the millions of dollars) across all the token holders.

Stack* has built a solution for redeeming points for ERC20 tokens trustlessly on any EVM chain, with a distribution method that is cheaper than traditional Merkle airdrops.

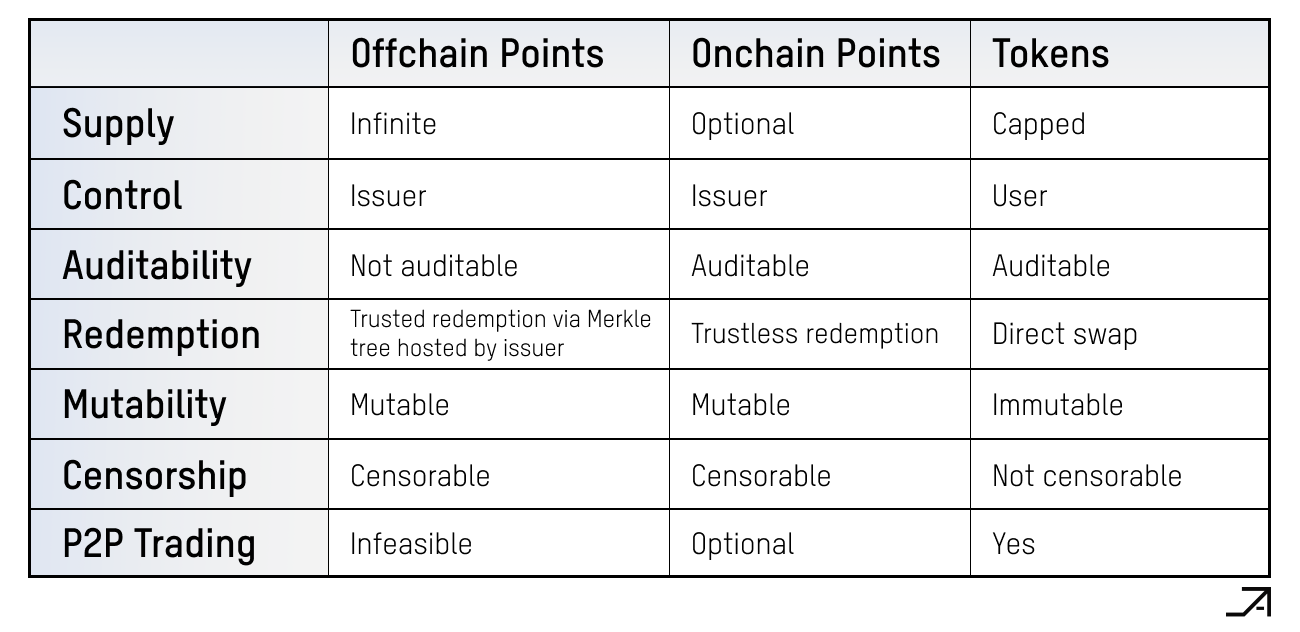

While the exact specifications of a point or token system can and will vary on a case-by-case basis, we’ve included a general delineation of characteristics of offchain points, onchain points, and tokens below for guiding reference.

Apart from any technical or crypto-specific implementation considerations, there are still plenty of other crucial design decisions for creating a point system. A few thoughts:

The primary goal of a project’s point system should be to encourage product usage, not to encourage point accrual. Ensuring that point schemes eventually drive users back to your own product ecosystem is key to successfully kicking off a flywheel driven by points, rather than encouraging farm and churn behavior. This is particularly important for value sustainability. Any value lost by offering rewards must be compensated by value elsewhere—more users, higher value transactions, upsells, subsidies through ads, etc. Channeling points directly into product benefits is particularly helpful for maintaining a closed feedback loop and testing the success of specific features/products. An example of this is Farcaster Warps, whereby points earned in the app can be used as gifts to other users, or used to discount in-app NFT purchases. This explicit use-case for points within the product reduces the risk that points are viewed primarily through a speculator’s lens; i.e. only as the basis for some future financial incentive.

An effective points system also requires an intuition of what will move the needle for both your users and your product. For example, if your users are relatively price insensitive, discounts may not be as interesting; other levers like personalization or social access/rewards may be more compelling for products that benefit from strong network effects. If your product is driven by time-in-session, dripping smaller rewards often and consistently may be more productive vs. products driven by large volumes may benefit from issuing higher-value rewards less often.

The Future of Points

The story of gamification is not a new one, and there are many case studies that demonstrate that gamification can lead to positive habit-forming, incentive alignment, and increased loyalty between brands and users.

When we look to the future, it becomes clear that decentralized, user-owned networks will define the new internet. In an onchain world, gamified points can serve as a unique way to identify and reward users for their actions and contributions in an even more powerful and holistic way than in web2. Therefore, it’s important to understand the goals and roles of decentralization and ownership in your product and design point systems with those goals in mind. While tokens are incredibly powerful tools to coordinate and govern these networks, they’ve proven to also be more rigid than originally conceived. Onchain points serve as a potential new primitive for teams to use alongside tokens to explore paths to better user identity, user ownership, and incentive alignment. However, points will only be conducive towards these goals to the extent that they’re carefully leveraged with these ends in mind. We’re excited to explore the possibilities of this new primitive with you.

*denotes an Archetype portfolio company

Thank you to Sina Habibian, Andrew Hong, Shreyas Hariharan, Linda Xie, Patrick Rivera, and Archetype colleagues Ash Egan, Benjamin Funk, Danny Sursock, Nick Pai, Tyler Gehringer, and Dmitriy Berenzon for thoughtful review and feedback on drafts of this post.

Reference list of sources instrumental to this post:

-

“Beyond Tokens: The Era of Onchain Points” by Graeme Boy

-

“Lessons on Points Programs for Crypto Apps” by Li Jin

-

Addiction by Design by Natasha Dow Schüll

Disclaimer:

This post is for general information purposes only. It does not constitute investment advice or a recommendation or solicitation to buy or sell any investment and should not be used in the evaluation of the merits of making any investment decision. It should not be relied upon for accounting, legal or tax advice or investment recommendations. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment or legal matters. Certain information contained in here has been obtained from third-party sources, including from portfolio companies of funds managed by Archetype. This post reflects the current opinions of the authors and is not made on behalf of Archetype or its affiliates and does not necessarily reflect the opinions of Archetype, its affiliates or individuals associated with Archetype. The opinions reflected herein are subject to change without being updated.